Image

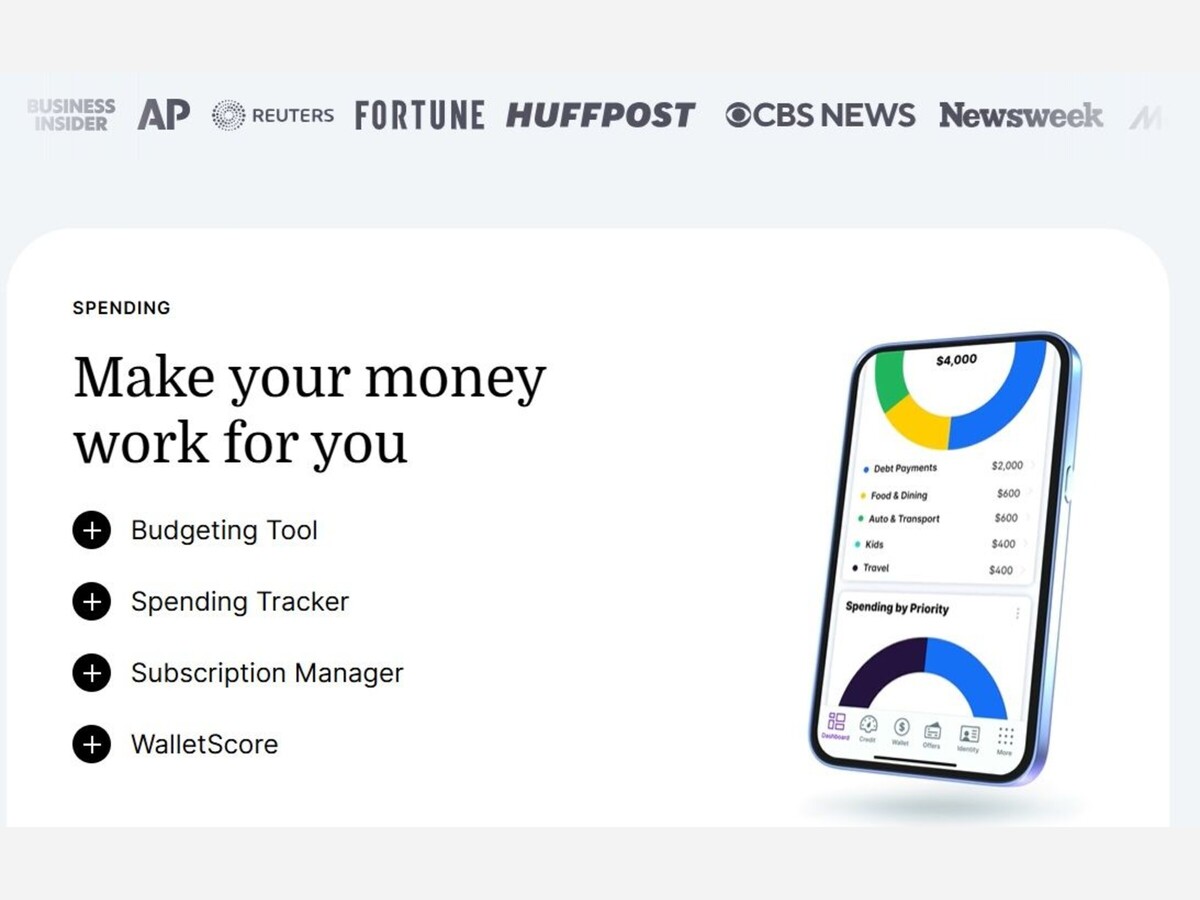

It offers a portal providing credit advice, including scores, reports, and monitoring, as well as reviews on financial products, professionals, and companies. WalletHub offers a top-rated solution for your credit, budgeting, investments, and identity protection.

Lilah Butler, Car Insurance Writer

Car insurance in Columbus, Georgia costs an average of $1,732 per year, or $144 per month.

Car insurance in Columbus is usually less expensive than car insurance in the rest of Georgia, due to factors like population density and accident rates.

|

Category |

Average Premium |

|

Minimum Coverage |

$1,690 |

|

Full Coverage |

$4,162 |

|

Young Driver |

$2,899 |

|

Senior Driver |

$727 |

Note: The young drivers' premium is based on drivers ages 16-20, while the senior drivers' premium is based on drivers ages 55 and 65. Actual rates will vary.

It's a good idea to compare quotes from multiple car insurance companies if you live in Columbus and are looking for cheap coverage. On average, drivers in Columbus can save up to $2,544 by comparing quotes.

The minimum liability car insurance requirements in Georgia are $25,000 in bodily injury liability insurance per person ($50,000 per accident) plus $25,000 in property damage liability insurance. These requirements can also be written as 25/50/25.

Key Things to Know About Liability Car Insurance in Georgia

Georgia is an at-fault state, which means the at-fault driver is responsible for paying for everyone injured in the accident. Drivers in Georgia are required to carry at least $25,000 in bodily injury liability insurance per person ($50,000 per accident) and $25,000 in property damage liability insurance. There are no restrictions on the right to sue after an accident in at-fault states, even if the insured buys personal injury protection (PIP)