Image

SPONSORED LEGISLATION by Jon Ossoff

S.Amdt.2696 to S.Amdt.2360 — 119th Congress (2025-2026)

Purpose: To amend the Internal Revenue Code of 1986 to extend the enhanced premium tax credits and increase the individual tax rate for taxpayers with income of $10,000,000.

Amends Bill: H.R.1 Sponsor: Ossoff, Jon [Sen.-D-GA] (Submitted 06/30/2025, Proposed 06/30/2025); Latest Action: 06/30/25 Amendment SA 2696 ruled out of order by the chair. (All Actions).

The part left out of the fringe anti-Ossoff mailers: Senator Ossoff voted to EXTEND premium tax credits to average families, not to cut them. He also voted to increase the tax rate on ultra-moneyed MILLIONAIRES, not "typical families."

The typical family in the USA (to the tune of about 98+-percent), and the State of Georgia, do not have a "typical family income" that reaches anywhere close to $500k, let alone $10M, so they are sending those mailers to the wrong audience. Reminds me of when Senator John McCain said "middle income" is people who have from $5 - $7M in income and assets and own only one or two houses. He had SEVEN houses, Senator Obama told him, and he didn't even know it until Obama said it. Fun stuff, huh?

Their only true audience is NOT in need of premium tax cuts, or any kind of tax cuts for that matter, since they are not the nation's biggest job creators or contributors.

Tax cuts for them are economy-killers - especially when considering that small businesses do most of the hiring in the USA.

By the time most people find out they received 'fake news' in these Republican-falsified anti-Ossoff mailers, it is usually too late.

Below are ACTUAL descriptions of new provisions from the One Big Beautiful Bill Act, signed into law on July 4, 2025, as Public Law 119-21, that go into effect for 2025.

Editorial Note: The No-Tax Tip Law is not retroactive, but even so, it does not ELIMINATE taxes on tips entirely. NO TAXES ON TIPS doesn't mean NONE in Republican-speak; you still have to pay Social Security and Medicare taxes. Overtime tax law is the same as stipulated above.

ACTUAL TRUTH: Ossoff and half of Congress (50%) did not vote against eliminating taxes on tips, they voted against THE ENTIRE BILL, which in essence, makes a fool of people who think they are going to benefit economically from this legislation, or "No Taxes on Tips and Overtime".

Tips and Overtime are still taxable. There are limitations that outweigh the matter in such a way that there is no derivable benefit that is going to save enough money for lower income employees to make a difference. It's an OBBTR: One Big Beautiful Tax Rouse.

Even the "car tax" benefit only applies to interest on CAR LOANS "up to $10k." Total. Hopefully, you aren't paying more than 10k a year in car loan interest, and you can forget the exemption if you buy a USED VEHICLE. You MUST create WHOLE NEW DEBT by purchasing a NEW CAR after December 2024 for that tax deduction to matter.

Recent Vote Against a Bill to Expand Child Tax Credit: In July 2025, Senator Ossoff voted against a bill, backed by President Donald Trump, which included provisions to expand the Child Tax Credit, among other tax changes and immigration enforcement measures. This vote drew criticism from some who argued he voted against expanding the child tax credit.

In summary, Ossoff has supported the Child Tax Credit in the past, voting for its expansion as part of the American Rescue Plan, and promoting its benefits for Georgia families. However, he recently voted against another bill that included child tax credit expansion, citing concerns about other aspects of the legislation, according to FOX 5 Atlanta.

The trade-off for that includes raising healthcare costs and eliminating so much that is beneficial to families that a family would take an entire hit for one Child Tax Credit that is still not going to benefit them in the short term or long term. All it will do -essentially- is raise the cost of everything else - so the money allegorically saved is only moved from those who need it to those who don't.

Trump does not understand how politics balance a budget and gives representation to both sides of the economic scale. All he understands is "making deals" and strategizing retail sales tactics that only turn a profit for those who already have too much money - all because they need a new car elevator in their $50M homes...

ONE tax credit versus a long-term increase that is going to cost MORE THAN it took to give the credit, which was not a gift in the first place. Money saved: NONE. The tax cut cost more to implement than it did not to have it at all.

As a matter of fact, to make up for the ONE BIG BEAUTIFUL tax credit cut, your taxes are going to go UP in other areas, costing far more than it would have if you had never gotten the credit at all. Prices are prices and they don't shift due to tax cuts, only due to lack of sales.

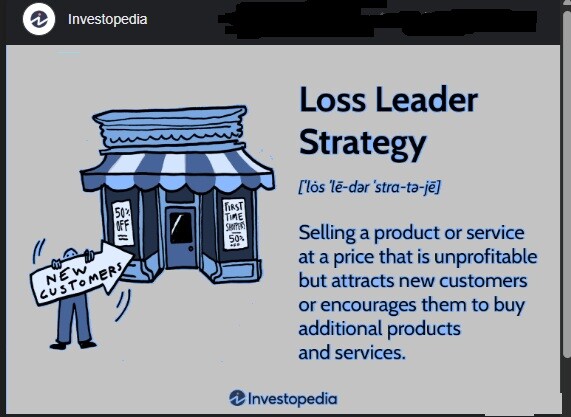

It's a trick most of us would call a "loss leader," a retail predatorial sales tactic for sales pitchmen where they give you something small and non-sequiter in exchange for a larger profit for themselves.

This one?

S. 5301 (118th): Veterans Home Loan Fairness Act of 2024 / Sponsor: Sen. Jon Ossoff [D-GA, 2021-2026]

This one?

S. 5120 (118th): Fresh Food Act / Sponsor: Sen. Jon Ossoff [D-GA, 2021-2026]

This one?

S. 4944 (118th): Access to Homeownership Act / Sponsor: Sen. Jon Ossoff [D-GA, 2021-2026]

This one?

S. 1977 (118th): Junior Enlisted Housing Affordability Act of 2023 / Sponsor: Sen. Jon Ossoff [D-GA, 2021-2026]

Editorial Note: The "Making Cars More Affordable" vote does not turn up as a valid search--meaning NOBODY in Congress is opposing legislation to make "cars more affordable." It doesn't exist.

But here IS what happened with the "car affordability" piece, another loss leader that seeks profit for car dealerships far more than it does tax breaks for those who get in debt to pay for it.

The Big Beautiful Rouse doesn't make cars more affordable. It is an exponential threat to off-setting these "credits" with higher prices and taxes elsewhere, particularly with US-made tariffs raising costs and prices so high that the tax cut is already spent before you get it.

In other words, there is no real pocket-filling incentive that is going to make enough of a viable economic difference to invoke a desire to buy more NEW cars, especially with the higher price tags that are coming with them.

Just like writing off taxable interest on a home loan for a house that got more expensive overnight, this bill isn't enough of a 'tax break' to make getting in MORE debt for a new car worth the smaller deduction if offers.

It is (a) Limited Scope: The deduction primarily benefits those purchasing new, US-made vehicles, leaving out a large segment of the market, including buyers of used cars or imported vehicles, who may be seeking more affordable options.

(b) Income Restrictions: The income limitations mean that some middle and higher-income individuals may not fully benefit from the deduction or may be excluded entirely. [Meaning no one is going to benefit unless they have upfront cash to pay for a BRAND NEW car dated AFTER Dec 31, 2024...]. Most low-income people can barely afford to purchase USED CARS from a 'BUY-HERE PAY-HERE' used car predator dealership, which does not qualify for this credit.

(c) Elimination of EV Tax Credits: The OBBBA eliminated the federal tax credit for electric vehicles, which previously provided a significant incentive for consumers to choose EVs, potentially impacting their affordability for some buyers.

There is absolutely NOTHING in Senator Ossoff's congressional voting record that indicates that he has done anything other than Sponsor, co-sponsor and/or vote FOR legislation that supports affordable housing for all homebuyers, including military veterans; and that he is doing everything in his power to stop Musk-confabulated DOGE from creating astronomical poverty in the USA by tax cuts that mostly hurt the people who are paying the bills, including his.

For Your Consideration: The Trump Administration walked into the Oval Office nearly from Day One firing thousands of people on the federal level, which was most assuredly going to drive jobless numbers through the roof--and did.

Most recently, he fired the Head of the Labor Department (Bureau of Labor Statistics) for telling the truth about how his actions caused job creation has dwindled down to almost nothing on his watch. There were only 73,000 jobs created January of 2025. Thus adding yet ANOTHER person to the list of unemployed people left in his wake.

Trump uses all of the Google keyword search terms that typically skew search term results, but the jobs numbers he claims happened never match the actual results of his actions. Also, he showed no legitimate proof that the BLS Commissioner lied "because she is a "Biden appointee"."

Now the nation is filled with unemployed people who are going to need JOBLESS BENEFITS AND UNEMPLOYMENT CHECKS soon enough, especially with a downturn in the economy that has led the nation back to COVID-19 pandemic level RECORD UNEMPLOYMENT due to current Trump administration policies, policies that will eventually lead to severe poverty, especially for those who won't be able to find work elsewhere. Great Depression, here we come AGAIN, and its always a Republican at the wheel every time the bus crashes.

EXCERPT: President Donald Trump on Friday ordered the firing of the head of the Bureau of Labor Statistics, hours after a stunning government report showed that hiring had slowed down significantly over the past three months.

Taking to Truth Social, he attacked Erika McEntarfer, the commissioner of the BLS. He claimed that the country's jobs reports "are being produced by Biden appointee" and ordered his administration to terminate her.

"We need accurate Jobs Numbers," Trump wrote. "She will be replaced with someone much more competent and qualified. Important numbers like this must be fair and accurate, they can’t be manipulated for political purposes."

He intensified his attack in a later post, writing: "In my opinion, today’s Jobs Numbers were RIGGED in order to make the Republicans, and ME, look bad." He didn't cite any evidence for his claim.

Today, [] Trump called into question the integrity of the Employment Situation report that the BLS released this morning.

He accused BLS Commissioner Erika McEntarfer of 'deliberately reporting false numbers' to reflect poorly on this administration. This baseless, damaging claim undermines the valuable work and dedication of BLS staff who produce the reports each month.

This escalates the President’s unprecedented attacks on the independence and integrity of the federal statistical system.

The President seeks to blame someone for unwelcome economic news.

The Commissioner does not determine what the numbers are but simply reports on what the data show. The process of obtaining the numbers is decentralized by design to avoid opportunities for interference. The BLS uses the same proven, transparent, reliable process to produce estimates every month. Every month, BLS revises the prior two months’ employment estimates to reflect slower-arriving, more-accurate information.

This rationale for firing Dr. McEntarfer is without merit and undermines the credibility of federal economic statistics that are a cornerstone of intelligent economic decision-making by businesses, families, and policymakers. U.S. official statistics are the gold standard globally. When leaders of other nations have politicized economic data, it has destroyed public trust in all official statistics and in government science. LINK

-30-